Geo Pricing

Consumers increasingly segment their purchases and consider price to be a very important factor in the choice of the brand (Sensormatic IQ 2022). It is essential for retailers to be perceived as the best value for money in each catchment area, but not at the expense of their profitability.

Geo Pricing is a way of adapting to consumer expectations, but it raises many questions for the retailers we meet. In this article, we explore how Geo Pricing’s responses to these questions – whether you price at a national level or on a store-by-store basis, in an integrated model or a network of independent stores. Indeed, Geo Pricing approaches will differ from a retailer to another, and a market to another, taking into account the retailer’s specificities, price sensitivities and product comparability.

- How to build a Geo Pricing strategy?

- What are the levers to use to perfect the strategy?

- What is the impact on the brand image of the retailer?

- Can a Geo Pricing strategy be compatible with an omnichannel strategy?

- What are the benefits?

If you are asking yourself these questions, this article is for you.

We define Geo Pricing as the personalization of prices or price recommendations for every point of sales (PoS), in order to adapt sales prices to the characteristics of each catchment area – competitive intensity, regional specificities, etc. Prices can be differentiated on all or a selection of the product range.

Why implement Geo Pricing?

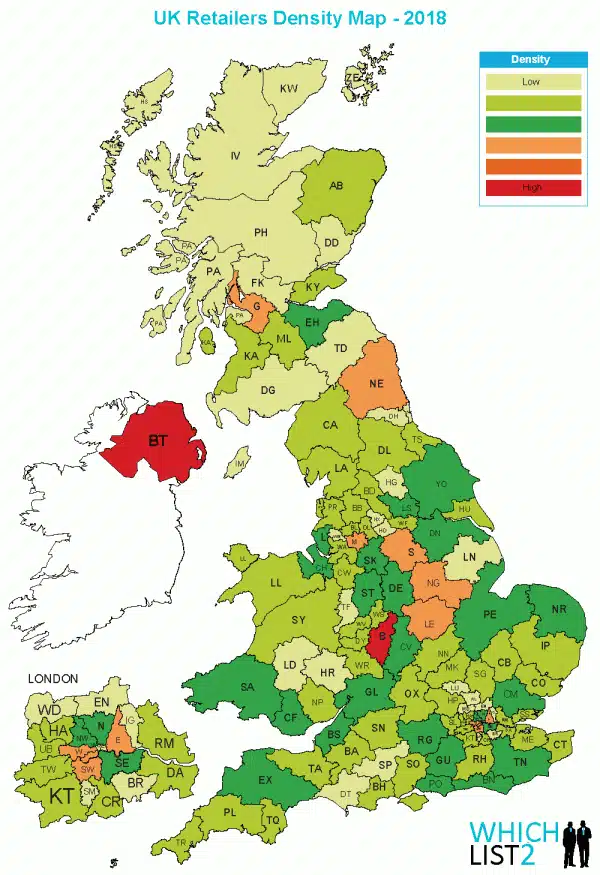

Source: Whichlist2 Retailers Lists

The retail sector is particularly diverse. 395,689 PoS in the United Kingdom. Among them, we will find craftsmen and merchants, franchisees or independents, specialised shops, discounters and superstores. These shops will be located in city centres, in large shopping centres as well as in isolated areas. Formats and sizes of stores will also be very diverse. The geographical distribution is also far from homogeneous over the country*. In this context, a retailer who integrates the geographical concept into its pricing will take advantage of these different environments and optimise its margin without losing competitiveness.

Improving competitiveness

A retailer’s ability to face competition consists in two forms of competitiveness:

- Structural or brand competitiveness is the ability to gain or maintain its market share thanks to its differentiating strengths such as specific product ranges, a service or a brand image. This competitiveness is acquired in the long run and is built up over time.

- Price competitiveness is quicker to adjust and must be consistent with the structural competitiveness. As mentioned, the competitive environment is not homogeneous, nor is competitiveness.

For a specific unit of need, price competitiveness is assessed by comparing with alternative offers considered by the consumer when purchasing. Alternatives considered will thus be in the same catchment area. Two shops of the same banner will therefore not face the same competition and will not measure their competitiveness the same way. Geo Pricing enables to adapt pricing strategies to the local competitors for each shop. You will then make a fine and efficient use of local price surveys, and ensure the good positioning of your shops in its catchment area.

Sales areas’ performance is also very disparate. Geo Pricing enables to focus pricing investments on areas with high economic potential. Levels of competitive alignment will then adapt to your commercial deployment strategy. If you are the market-leader in your area with a high level of customer loyalty, the price gap with your competitors will not be the same as if you are challenged or conquering new consumers. Geo pricing enables this precision.

Optimising your margin

Investing in your price index is costly, this investment must be made wisely. Activating margin levers in areas with low competitive pressure opens reinvestment’s possibilities in areas with high competition:

- By exploiting the different shop environments, thanks to catchment area analyses: each shop’s positioning is assessed in relation to local competitors, in a targeted manner. This puts an end to unjustified and margin-costly price alignments.

- By adjusting pricing to the diverse consumer profiles and segmenting strategies according to socio-demographic criteria, consumer habits or the area’s economical landscape. Consumers’ price sensitivity is not uniform. Geographical disparities can be highlighted by geomarketing studies and integrated into pricing strategies.

- By taking into account the specifics of regions, such as shops located next to a border, which have different operating costs and require specific profitability management. The customers of these shops have lots of possibilities when it comes to choosing a place to shop, and the shops’ attractiveness depend on the economic context of the countries. Currently, inflation is disrupting the habits of cross-border consumers and challenging the shops on their pricing;

Geo-pricing makes it possible to improve the price image of shops that would be out of position in relation to a very competitive catchment area, without investing in margins over the whole territory. It also makes it possible to optimise margins by adjusting prices that are too low in a weak competitive area, without losing competitiveness.

Building confidence in pricing for all stakeholders

Geopricing helps to improve your performance indicators. Consumers are aware of the offer and the brands in their catchment area only. And when a retailer analyses customer perception, he cannot ignore this reality: consumer is not all-knowing, his perception is built on partial knowledge of prices and available alternatives. In order to effectively analyse your brand’s performance indicators and price image, it is essential that these indicators reflect this reality. To do this, once you have determined your catchment areas and the competing shops to be taken into account, you will integrate these elements into the calculation of your price index. Your price index then reflects the consumer’s view. It will reliably reflect the price image of your brand.

In a network of franchisees, store-by-store pricing favours confidence in central’s price recommendations: they are consistent with the local vision the teams may have on the field. Prices are then more likely to be applied by franchisees, and the central office benefits from a better indicators’ quality. Economic objectives that will be defined beforehand are then realistic. You can project your pricing strategies’ results more reliably and adjust with full knowledge of the facts. You are no longer steering blindly. The analysis of this shop price discrepancy also enables readjusting and fine-tuning your pricing rules.

Industrial area Isolated DIY store

How to implement this new strategy?

Adjusting the selling price of a product according to its brand, its technical characteristics, its place of production and its cost is a no-brainer for distributors. Several products can meet the same unit of need with different prices. On the other hand, adapting the selling price of a product according to consumer profiles, to a competitive environment or to seasonality, requires a rethinking of its data management, a reflection on its omnichannel strategy, and can raise questions regarding change management.

What competitive data is needed for store-by-store pricing?

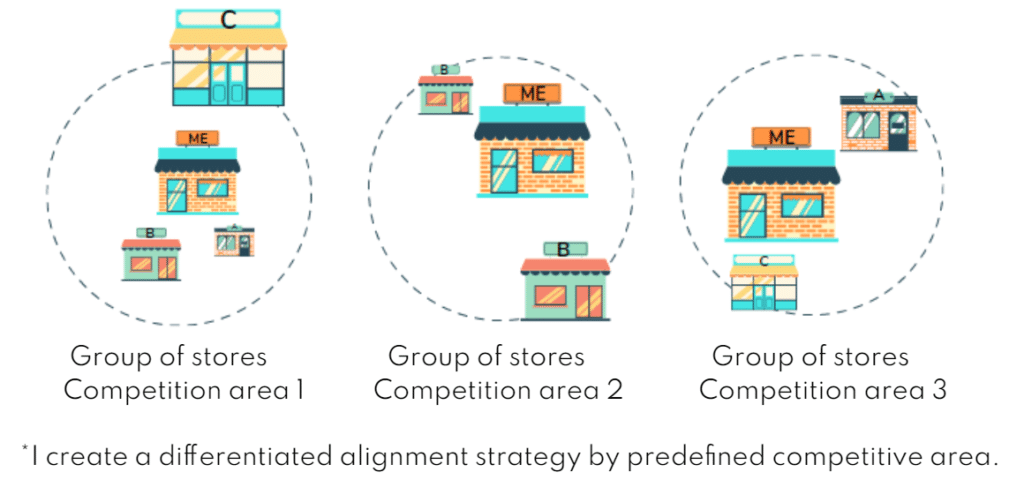

One of the most common questions when discussing geopricing is: « Would I have enough competitive data? Measuring competition in each catchment area on a product-by-product basis through local surveys is the most refined approach to geo-pricing, but it is not the only way to do geo-pricing. A national price survey can also be used to optimise prices according to local competition. Retailers can establish catchment area typologies, based on local competition. For example, clustering shops by typical competitive environment (presence of competitor A or not, presence of competitor B or not, etc.). For each cluster, pricing strategies will be personalised. Indeed, why would we systematically take into account the prices of my competitor B if some of my shops do not have this competitor in their catchment area?

The analysis of the catchment area and the personalisation of the strategies make it possible to transcribe a pricing strategy that is closer to the reality on the field without losing competitiveness: even if your price indices increase for certain shops, the consumer has no possible comparison in his area.

How can I manage my omnichannel with geo-pricing?

« E-commerce has made all products extremely comparable, differentiating my prices from my website will destroy my price image, consumers will not understand the price differences. »

We often hear this point, which may indeed be true, but it is never an absolute truth.

For retailers with a store locator on their site, such as in DIY or food, this is not a problem. Each shop can have a different price, this practice is commonly accepted is part of the accepted practice of the consumer.

For other models, this refers to the weight of the price in the purchase decision and the consumer’s acceptance of a price differentiation between the website and the shops. Our clients’ experiences show that retailers tend to overestimate the likelihood of consumers to check prices on the internet before making a purchase in shop.

Indeed, some of our clients ran studies on consumers’ tendencies to compare on the web before visiting shops. Results showed a lower inclination to compare prices than was commonly believed. Moreover, this comparability on the website does not apply linearly to the product offer, some products are more compared or comparable than others. The problem arising is therefore not whether to differentiate prices or not, but rather which products to differentiate or not. The job of the pricing teams will then be to identify sensitive products using algorithms, and to isolate them in a unified strategy at national level. We have written an article on this subject, we invite you to read it if is it of interest to you.

Segment your strategy according to price sensitivity in an agile way, integrate tolerance thresholds with respect to your web price and work on the precision of your competitive alignment based on the reality of the market.

Change management

Many category managers know the pricing of their best products inside out. When prices are differentiated by shop, this level of knowledge is inevitably lost. This is not always easy for the teams to understand. In addition, there is the question of the workload that this could represent: the fact of multiplying the price of a single product multiplies the time required for check-ups.

Several answers can be given to these concerns. Firstly, the implementation of Geo Pricing is accompanied by a modernisation of the pricing solution in general. The control phase is therefore considerably reduced and facilitated by analysis tools and alert rules defined upstream. The workload is not increased in any way, on the contrary: tedious tasks are automated, and the pricing or marketing teams concentrate on the tactical or strategic aspects of pricing.

Furthermore, Geo-pricing implies a new approach: price is no longer an operational choice, it is the result of a strategic positioning of the retailer in accordance with price and control rules. The mission of category managers and pricers is to ensure that pricing is consistent with the company’s strategy, that objectives are met and that strategies are tested and implemented. The point is to involve all the operational teams in this new approach. Change management plays an important role at all levels in the implementation of Geo Pricing. To ensure that all the players involved in pricing are on board, it is important to simulate the impact of this new approach. Test, simulate, compare and propose different scenarios. Allow everyone to understand the construction of each price in complete transparency. Such a project needs to be implemented step by step. There is no need to opt for all in Geo Pricing or nothing. And you can count on Mercio’s team of experts to support you.

Optimising margins, gaining competitiveness and finesse in analysis is the wish of every retailer. Geo Pricing offers you this possibility and opens up the field of possibilities in terms of retail strategy.