Price image: how do you measure and manage consumer perception?

In times of inflation, consumers are turning to the discounters in the belief that these stores will offer the lowest prices for their everyday purchases. (LIDL +1.1 pt and ALDI +1.7pt of market share versus December 2022 versus December 2020.)*

The growing influence of discounters is intensifying the price image war in the grocery market. Shopping at a discount store remains a consumer alternative that is seen as devaluing by a proportion of the UK population**. The quality of service and support offered by a traditional retailer remains an asset.

How can the retailer work on its price positioning and image to be perceived by the consumer as being at the right price while maintaining its image?

At Mercio, we define price image as the perception that consumers have of the price level of a brand. Price image is a hybrid concept. It involves both clear quantitative elements such as product prices or the differences between them and competing brands, but also qualitative elements such as the consistency of prices with the identity of the retailer as a brand. As the elements constituting the price image are both conscious and unconscious, the analysis of the price image is particularly complex.

It would be quite tempting to reduce the measurement of price image to the calculation of average price indices compared to competitors. However, this shortcut does not do justice to the company’s price image and offers only a fraction of the performance of the pricing strategy. After all, what do retailers ultimately care about, is it the reality of their price positioning or consumer perception?

In this article I will explore the price image from the consumer’s perspective and put the spotlight on some good practices in pricing management.

Price levels, price image and brand image: combining these three marketing concepts rather than confusing them.

We regularly read articles in the specialised press suggesting a ranking of retailers according to their price index. In almost all cases, the price index serves as a measure of price image and is averaged at the national level. The terms price index and price image are therefore often confused. The criteria used by these rankings provide only partial information about consumers’ perceptions of these shops and do not constitute a complete analysis of price image. To complete the analysis, it is necessary to ask whether consumers find on the labels the promise that the brand has made in its communication and identity.

The consumer forms a price image from all the signals sent by the brand. Merchandising, promotions and offers help to build an opinion of the brand and to evaluate its positioning. Extended opening hours, proximity or a large range of products are all services whose value is perceived by consumers. These services therefore also have an impact on the acceptability of the price and contribute to the construction of the price image. These elements play an unconscious role for the consumer. I know that the prices in this store are higher, but this seems justified to me: the shop is « better », « I have more choice », « it’s easier to shop there », « it’s pleasant ».

In short, a good price image does not require being the cheapest. Monoprix, a French supermarket, has a higher price positioning than its competitors, but this is not detrimental to its price image. In the 2000s its high price positioning was challenged by the deployment of discounters in direct competition. In order to maintain a good price image, Monoprix decided to increase its brand value through its products and to promote quality, by increasing the service offer and by adopting a new marketing strategy. This new approach has been successful and has helped to justify a higher price to the consumer.

The consumer may be aware of the high positioning of the brand of his choice, but still have a positive attitude towards the brand’s price image. This is particularly true if the quality of the products and services offered justify this positioning. Conversely, even the lowest price on the market may be badly perceived if the quality of the product is not consistent with the consumer’s expectations, and the brand’s price image will be damaged. A discount shop will not offer the same customer experience as a traditional shop. The price image is therefore not only the result of the prices charged by the store. It is a question of proposing an offer in which the products, prices, merchandising and promotions are consistent with the brand’s promise.

Measuring the price image: how to calculate a price index that reflects the subtleties of customer perception?

L’indice prix est un indicateur indispensable pour piloter son pricing. Il permet à l’enseigne de se positionner sur le marché face à ses concurrents. Mais, comme vu plus haut, il ne suffit pas à retranscrire l’image prix que l’eThe price index is an essential indicator for pricing management. It enables the retailer to position itself on the market in relation to its competitors. But, as we have seen above, it is not enough to transcribe the price image that the retailer has with its consumers. The price index is a rich indicator which, with some sophistication, can ensure that the pricing policy corresponds to the desired price image of the brand in the eyes of the consumer.

Steering competitiveness indices at the local level

Geographical finesse is a key to success. To illustrate this, this Leclerc advertisement responding to a Carrefour marketing campaign made us smile.

This very clever formula highlights an important point for retailers to consider. When shopping for food, consumers do not choose their brands by looking at the « average French » but rely on their personal and therefore local experiences.

Matching my analysis to that of my consumers

For our weekly purchases at the supermarket, it is at the checkout that the price image we perceive of the store is revealed. We have in mind a threshold of acceptability concerning the amount that we will be asked for, whereas the price increase of an isolated product may go unnoticed. It is therefore the price positioning of standard baskets that is interesting to analyse, closer to a consumer reality than to a simple management concept.

The big retailers are able to collect a lot of data about their customers. Although dealing with this massive data is a challenge, it is worth the effort. By identifying typical consumers and analysing their shopping baskets in real time, you can create price indices that reflect your customers’ shopping habits, even as they change. In this way, you can measure the impact of your pricing decisions on consumer behaviour directly and accurately for each shop.

Such price indices allow you to set prices that are both fair to your consumers and accurate enough to target your investments. In this way, you achieve optimal positioning and minimise costs for your business.

Category management: an under-exploited method of influencing the price image?

We tend to think that a price speaks for itself, but category management experiences show that the accuracy of a price is almost exclusively assessed by comparison. The specialist in Behavioural Economics, Daniel Ariely, author of « Predictably Irrational », provides us with interesting elements of analysis in his studies of the decision-making process. He raises the paradoxes of our daily decisions to highlight the real reasons for our choices.

As a university professor, he conducted a study with 100 of his students:

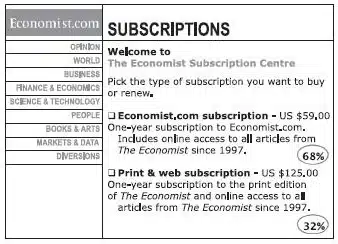

He offered a first group of students a subscription to the newspaper, « The Economist ». This first group had the choice between a $59 online subscription and a $125 print + online subscription.

68% of the students chose the $59 web version.

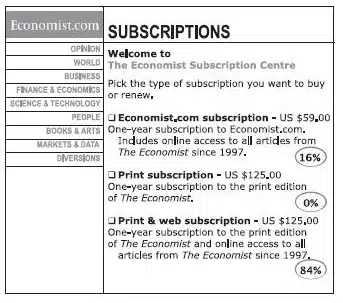

To the second group he added an alternative option, the paper version only for the price of $125 which is the same price as the paper + web version. Obviously, this proposal is of no interest since for the same price you can subscribe to the paper + WEB version.

But surprisingly, in this case 84% of students chose the paper + web option at $125. Adding an option that would not have generated any sales boosted the attractiveness of the more expensive option.

What does this study tell us about our topic? Consumers make their choice by taking into account all the elements and options available to them. The comparison modifies the perception of a price as « fair » or not. This comparison structures a different scale of value.

Depending on the type of product, the consumer will certainly evaluate the prices according to his idea of competitor prices. But above all, he will evaluate them in relation to the whole range of products in the same store. This study shows that for a price to be perceived as « good » it must be strategically positioned within the offer. This underlines the importance of defining a price by taking into account its place within the range and its positioning within the shelf

This organisation of the range by the right price differentials enables retailers to highlight the uniqueness of their offer in their price image. One chain will aim to present the most attractive prices on national brands, while another will emphasise the accessibility of the lower prices, or the excellent quality/price ratio of its private labels.

Price consistency is therefore a determining element of the price image. If it is mastered, it brings 3 strategic advantages:

- The consumer perceives the price as being fair in relation to the other products on the shelf.

- The consumer has confidence in the prices presented to him, and will then pay less attention to prices in his purchasing process

- Controlling this price consistency makes it possible to position products strategically with each other, and therefore to direct purchases towards particular products.

Range consistency helps to improve the brand’s price image. If it is managed with finesse, it becomes a formidable weapon for boosting the sales of your own brands.

Conclusion :

The role of pricing is to capture the notion of price image, to understand its sources and to approach it in an objectifiable way. To do this, pricers have several tools at their disposal:

- The brand strategy enables the main areas of work to be determined

- A sophisticated price index enables the positioning to be analysed through the perspective of the consumer

- Category management helps to reinforce the consumer’s choice on the shelf and to confirm their decision to visit the store

At Mercio, we are developing the platform that enables retailers to address these issues. We would be happy to discuss this in more detail with you if pricing is your priority today!

*Source KANTAR

**Source Observatoire Cetelem